Book Up Partnership Assets

But learning about your finances isn t as hard as you might think.

Book up partnership assets. Books are often out of date or inaccurate. If the partnership goes out the next day and sells the property for 100 the partnership will have a different amount of book and tax gain. This profit or loss is then allocated to the capital accounts of each partner based on their proportional ownership interests in the business.

Most of all it can save you money and help you make better business decisions. For book purposes the partnership will have a basis in. Worries about running out of cash can keep you up at night.

In addition clients with partnership and limited liability company agreements which recite the circumstances under which capital account adjustments are permitted may wish to amend their agreements to include the grant of an interest for services. The gain is allocated to the partners capital accounts according to the partnership agreement. When a partnership closes its books for an accounting period the net profit or loss for the period is summarized in a temporary equity account called the income summary account.

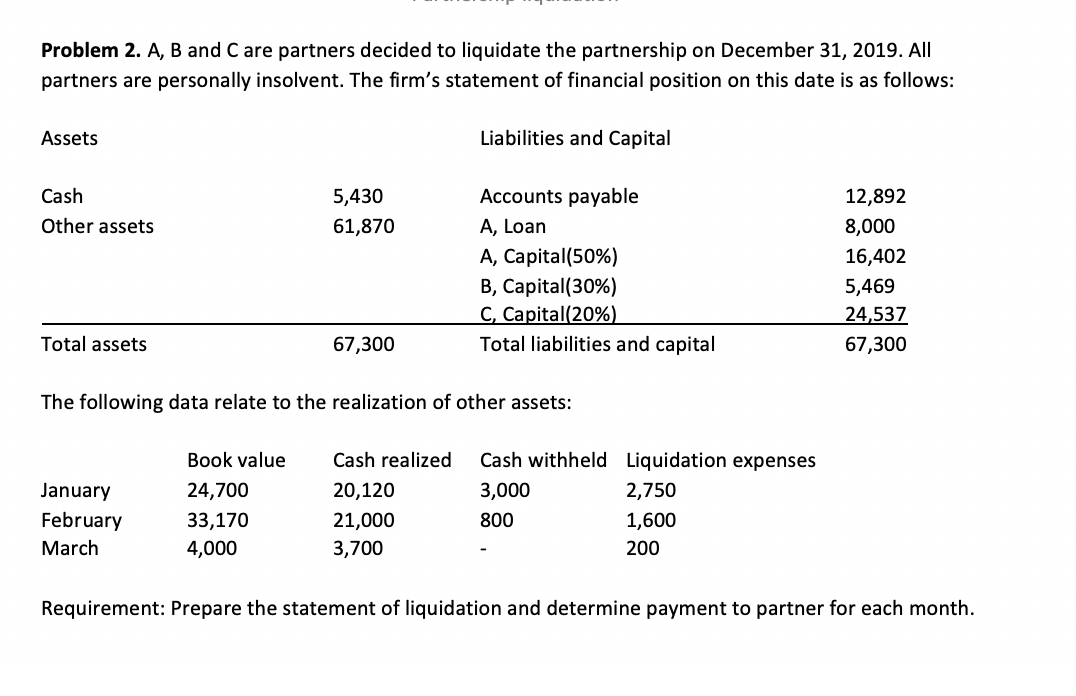

If non cash assets are sold for more than their book value a gain on the sale is recognized.