Book Value Per Share Formula Example

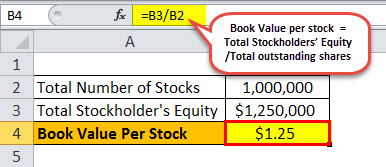

Total number of outstanding shares.

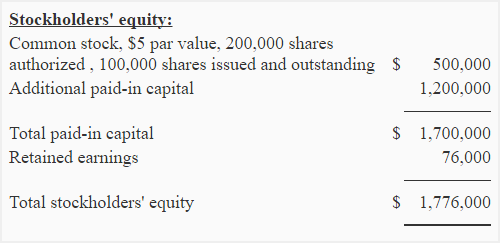

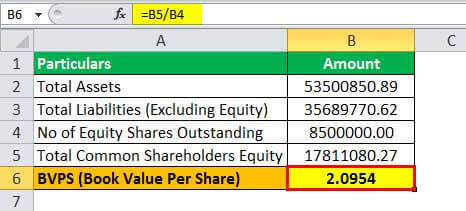

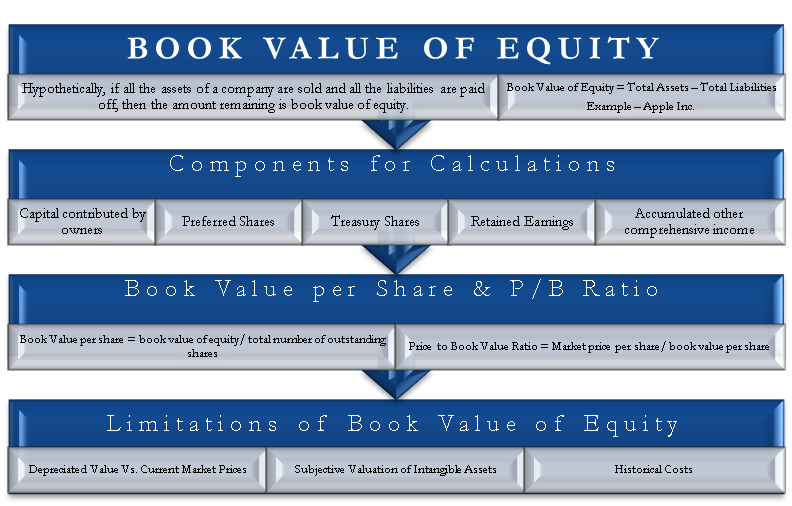

Book value per share formula example. Total outstanding shares total number of shares issued shares as treasury stock. Shareholders equity preferred shares. Using the previous example assume that the company repurchases 500 000 common stocks from its shareholders.

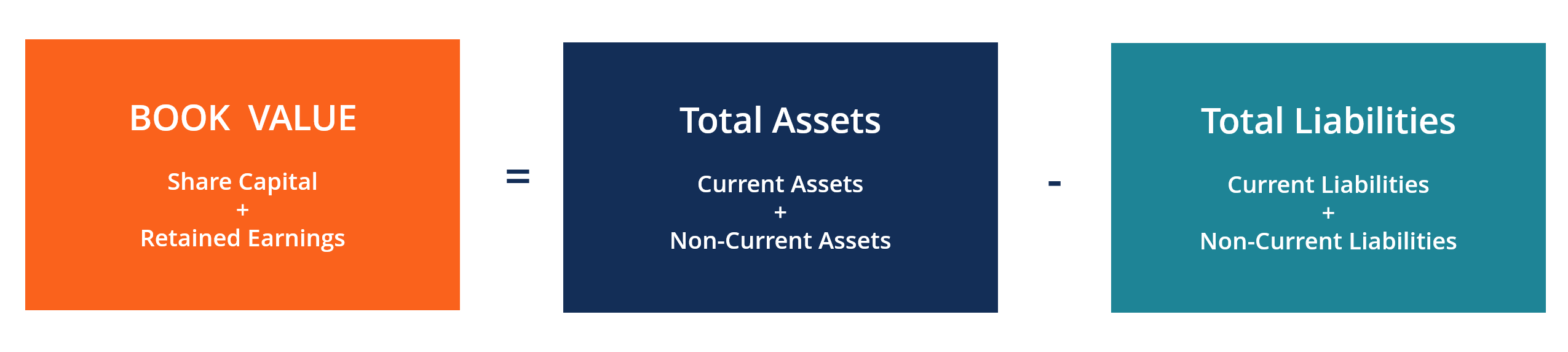

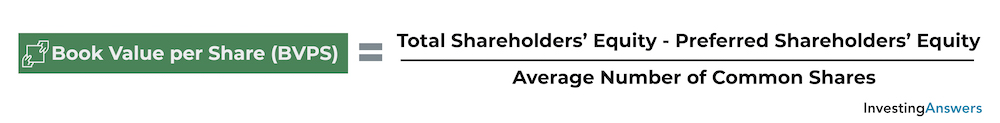

Book value per share. Book value per share shareholders equity preferred equity total outstanding common shares. It will reduce the current shares outstanding to 2 5 million 3 000 000 500 000.

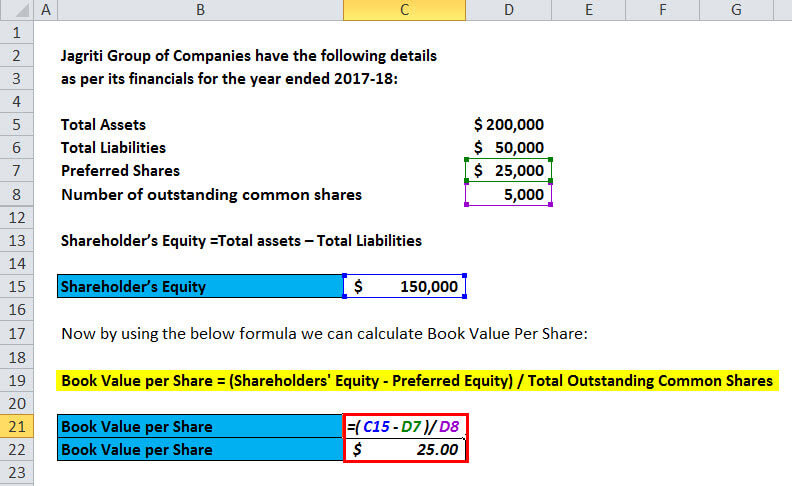

Book value per share 1 50 000 25 000 5 000. One of the main ways of increasing the book value per share is to buy back common stocks from shareholders. Outstanding the formula requires you to know the company s total equity.

Book value per share is determined by dividing common shareholders equity by total number of outstanding shares. Book value per share of jagriti group of companies is 25. Book value per share 1 25 000 5 000.

:max_bytes(150000):strip_icc()/pb-5c41d8e3c9e77c000125d987.jpg)