Book Value Per Share Philippines

Pengertian book value per share nilai buku per saham dan rumusnya book value per share bvps atau dalam bahasa indonesia disebut dengan nilai buku per saham adalah rasio yang digunakan untuk membandingkan ekuitas pemegang saham dengan jumlah saham yang beredar.

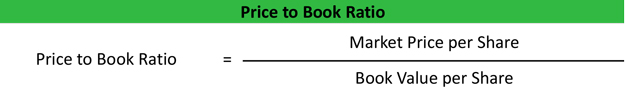

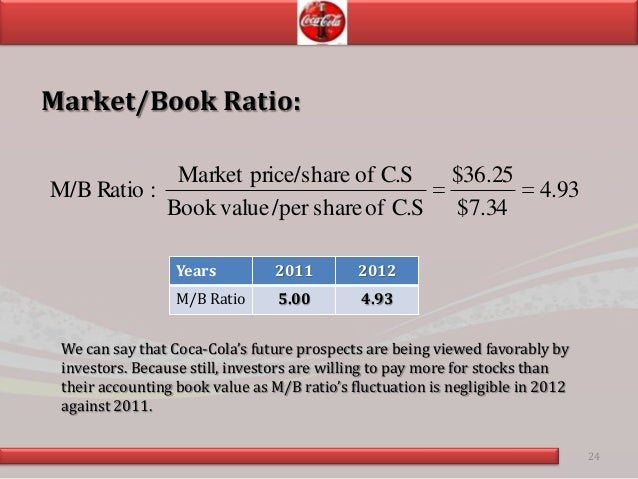

Book value per share philippines. Hence today s pb ratio of j2 global is 3 98. Formula to compute book value per share. The book value per share is calculated using historical costs but the market value per share is a forward looking metric that takes into account a company s earning power in the future.

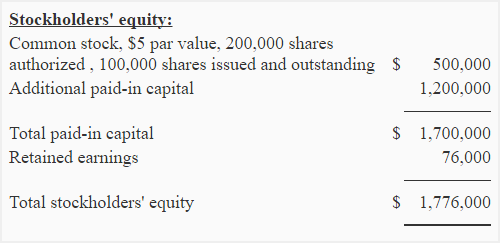

J2 global s current price is 98 410000. Bvps 50 000 2000 25 per share. If the investors can find out the book value of common stocks she would be able to figure out whether the market value of the share is worth it.

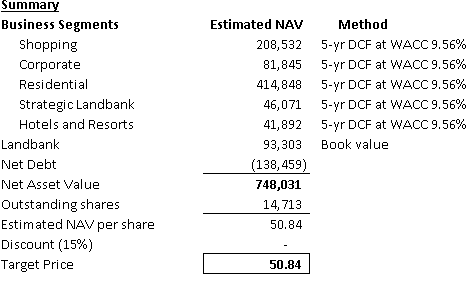

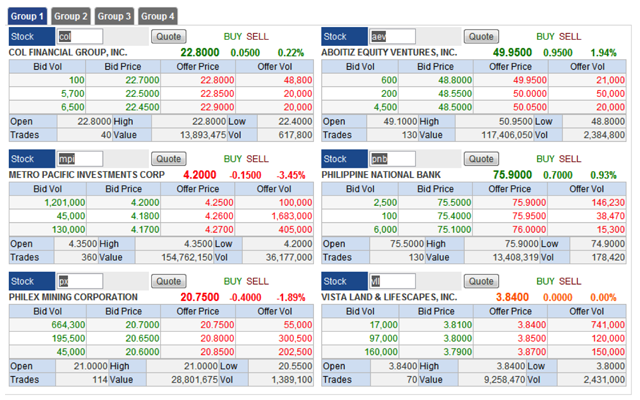

Investors need to look at both the book value and market value of the share. One way to look at the idea of bvps is to consider that for every share that you own the company is actually worth 5 pesos. With the example above the book value is 500 000 pesos.

What does this mean. The market value is forward looking and considers a company. Book value per share formula of utc company shareholders equity available to common stockholders number of common shares.

Dengan kata lain rasio book value per share ini digunakan untuk mengetahui berapa jumlah uang yang akan diterima oleh pemegang. And the median was 15 30 per year. For example stock of company x has a market value of php 25 00 but its book value is at php 45 00.

The book value per share may be used by some investors to determine the equity in a company relative to the market value of the company which is the price of its stock. Book value per share and earnings per share book value per share the amount that would be paid on each share assuming the company is liquidated and the amount available to shareholders is exactly the same as the amount reported as shareholders equity. The market value per share represents the current price of a company s shares and it is the price that investors are willing to pay for common stocks.