Book Value Per Share Ratio Definition

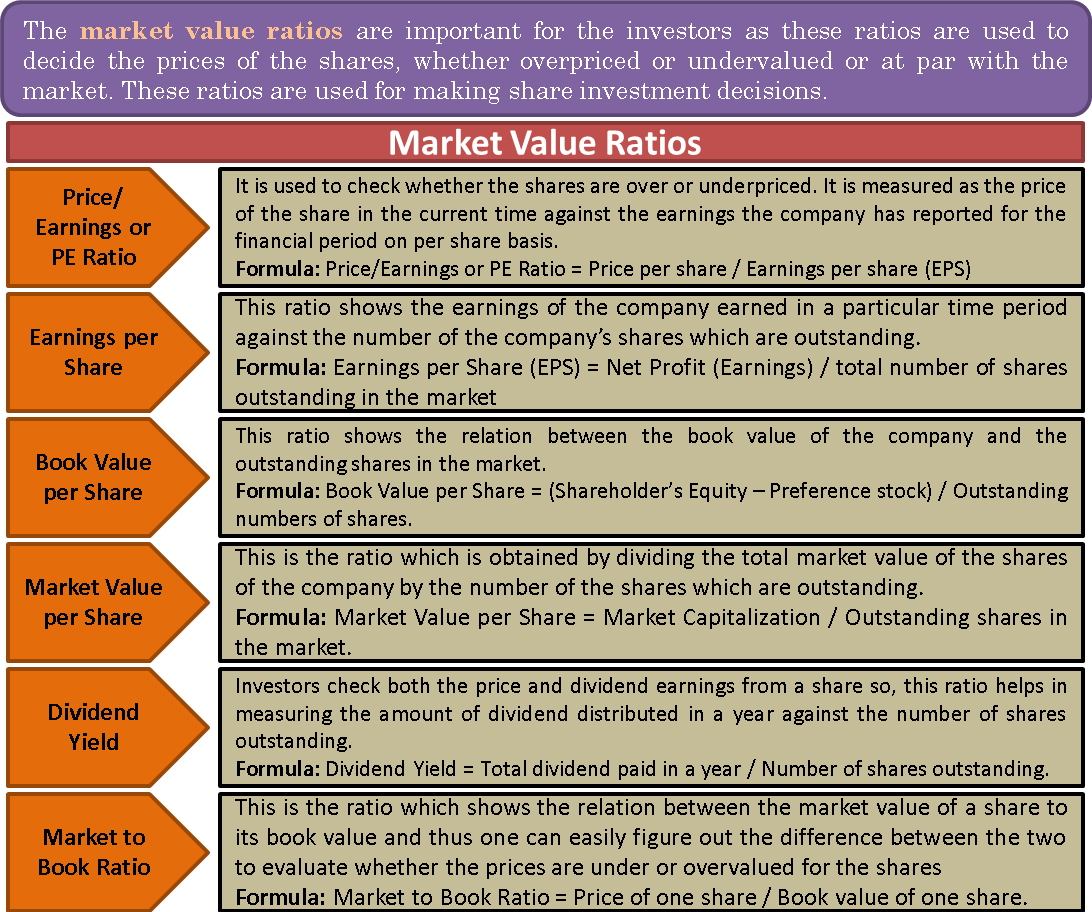

Book value per share is a fairly conservative way to measure a stock s value.

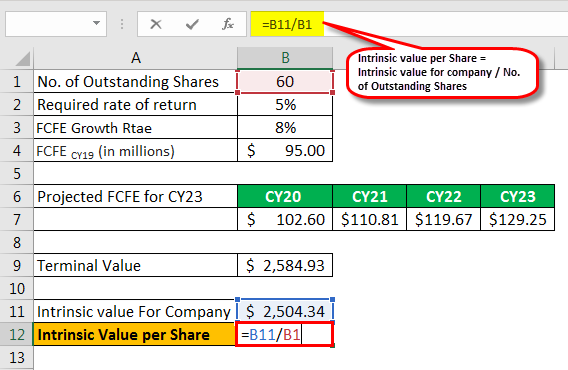

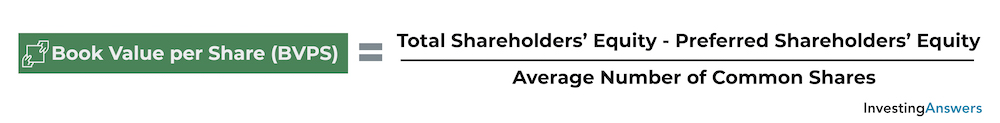

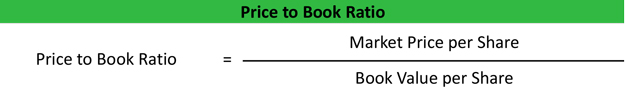

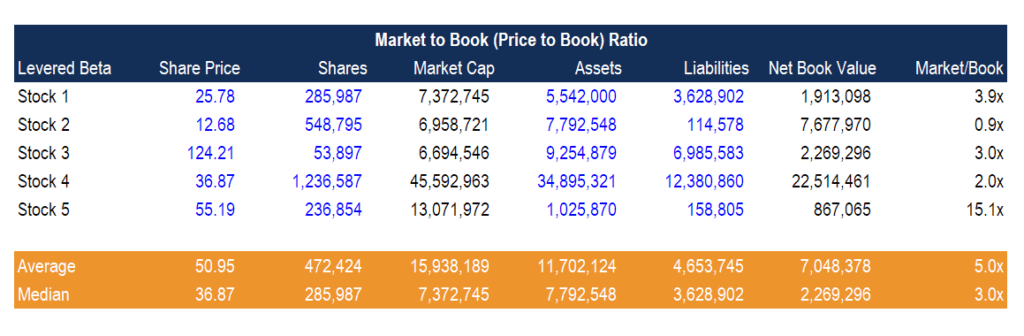

Book value per share ratio definition. The book value per share bvps is calculated by taking the ratio of equity available to common stockholders against the number of shares outstanding. When compared to the current market value per share the book value per share can provide information on how a company s stock is valued. The price to book p b ratio is a popular way to compare book and market values and a lower ratio.

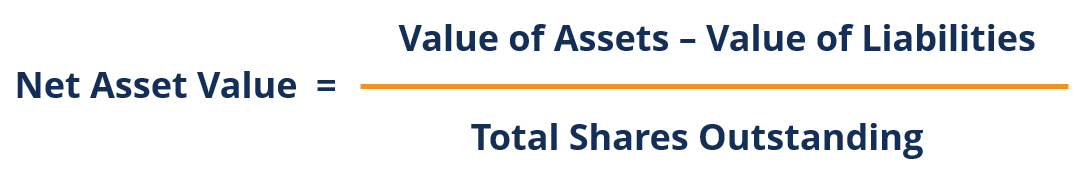

The market value per share is a forward looking measure of what the investment community believes a company s shares are worth. Book value per share is a way to measure the net asset value investors get when they buy a share. What is the book value per share bvps.

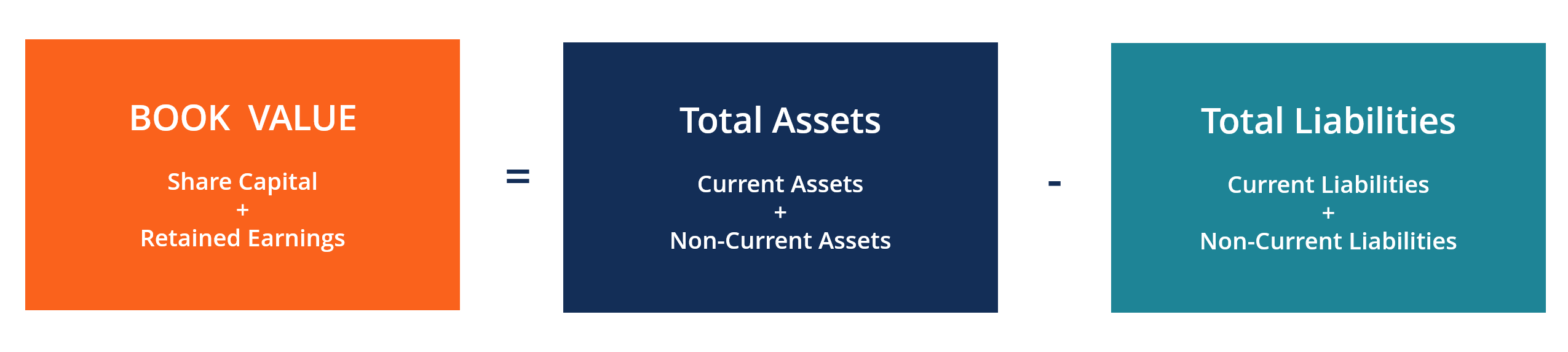

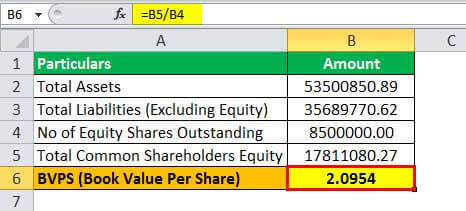

In the case that the firm dissolves it is the amount the shareholders will receive. Book value per share bvps is a ratio used to compare a firm s common shareholder s equity to the number of shares outstanding. Book value of equity per share bvps is the ratio of equity available to common shareholders divided by the number of outstanding shares.

The book value per common share is a financial ratio that calculates amount of equity applicable to each outstanding common stock. What does book value per share mean. It s calculated by dividing the company s stock price per share by its book value per.

Book value per common share or simply book value per share bvps is a method to calculate the per share book value of a company based on common shareholders equity in the company. In other words this is the equity value of each common stock. Consequently it is dangerous to compare the two measures.

Comparing bvps to a stock s market price could help value investors find opportunities. The two measures are based upon different information. Book value per share is a ratio that compares the net asset value of a company minus preferred equity to the total number of common shares available on the market.

:max_bytes(150000):strip_icc()/pb-5c41d8e3c9e77c000125d987.jpg)

/pbratio-38e5cff99f884633a152df2a61dcb31e.jpg)

:max_bytes(150000):strip_icc()/GettyImages-589090389-745fd0d8ae1648dba52b26d45029eaa4.jpg)

/dividendyield-5c67fc5946e0fb00011a0c31.jpg)