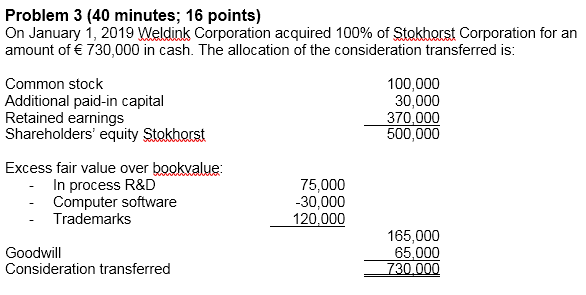

Book Value Retained Earnings

Book value of equity consists of two economically different components.

Book value retained earnings. Using this simple formula the statement of retained earnings is prepared. Book value of an asset book value of bonds payable book value of a corporation and the book value per share of stock. The retained earnings formula represents all accumulated net income netted by all dividends paid to shareholders.

Book value of equity consists of two economically different components. Book value of equity formula it is calculated by adding the owner s capital contribution treasury shares retained earnings and accumulated other incomes. The term book value is used in a number of ways.

Beginning value of retained earnings net income dividends ending amount of retained earnings. The ratio of the book value of equity to the market value of equity is a common measure of value. We rst decompose the book value of equity into capital contributed by shareholders and earnings retained by the rm.

We predict that book to market strategies work because the retained earnings component of the book value of equity includes the accumulation and hence the averaging of past earnings. Book value is the accounting value of the company s assets less all claims senior to common equity such as the company s liabilities. Stockholders equity is often referred to as the book value of the company and it comes from two main sources.

Mathematically it is represented as book value of equity formula owner s contribution treasury shares retained earnings accumulated other incomes. Retained earnings are part of equity on the balance sheet and represent the portion of the business s profits that are not distributed as dividends to shareholders but instead are reserved for reinvestment. Retained earnings are accumulated over the years on the balance sheet and calculated as.

Retained earnings and contributed capital. Retained earnings which is all of the historic earnings from operating companies bnsf for example plus realized gains on the investment portfolio stocks it sold at a gain or loss minus any. We predict that book to market strategies work because the retained earnings component of the book value of equity includes the accumulation and hence the averaging of past earnings.