Book Value Using Macrs

If you qualify for a section 179 deduction like most businesses you can deduct the full cost of assets up to 500 000 in the year of purchase instead of using macrs.

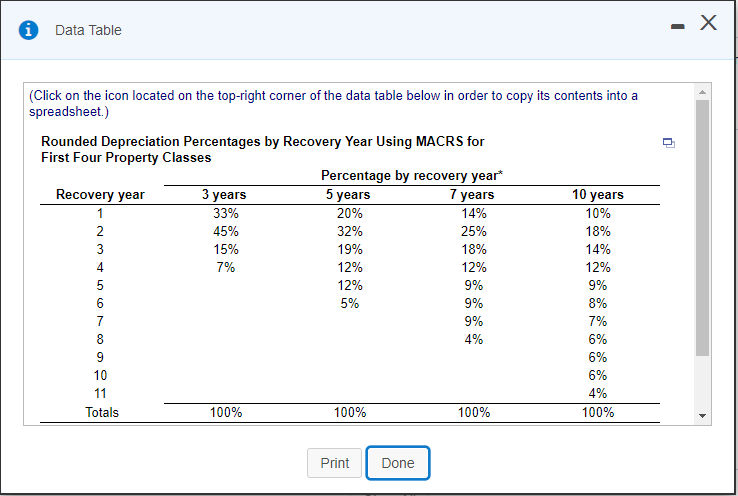

Book value using macrs. Macrs declining balance changes to straight line method when that method provides an equal or greater deduction. The book value at the end of the recovery period will be zero. Also although macrs is based on the double declining balance method the percentages in the tables are always applied to the original basis value never the book value.

This is because the asset is always depreciated down to zero as the sum of the depreciation rates for each category always adds up to 100. With this handy calculator you can calculate the depreciation schedule for depreciable property using modified accelerated cost recovery system macrs. Unlike the straight line method which requires estimations for salvage value of the asset and its useful life macrs is based on a percentage chart published by the irs.

When using macrs an asset does not have any salvage value. Macrs modified asset cost recovery system method is used for income tax purposes and is the accelerated depreciation methodology required by the united states. Set of trucks costing 400 000.

Macrs stands for modified accelerated cost recovery system because it allows you to take a larger tax deduction in the early years of an asset and less in later years. The depreciable basis is the amount paid for the asset including all costs related to acquisition such as installation transportation and modification costs. Deduction under 200 declining balance macrs for 2013 would be 6 91 million 100 20 32 19 2 11 52 1 5 200.

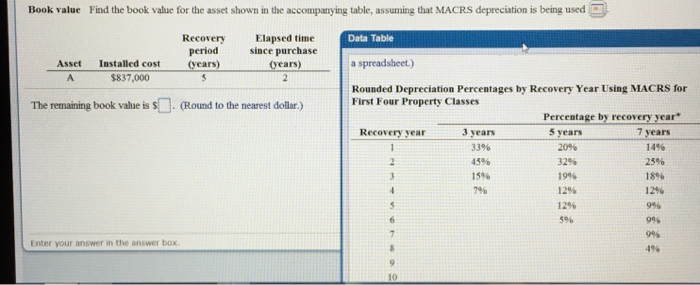

Using the macrs tables determine the depreciation and book value for each year for the first ten years for. An asset with a 3 year recovery period has an initial cost basis of 10 000. Determining book value using macrs depreciation book value is the depreciable basis or historical cost minus accumulated depreciation.

Alternatively you can use a macrs tax depreciation calculator to determine your deductions.