Justified Price To Book Value Formula

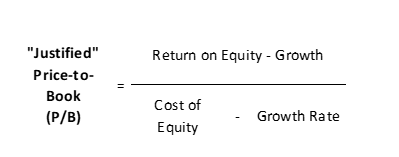

It uses the sustainable growth relation and the observation that expected earnings per share equal book value times the return on equity.

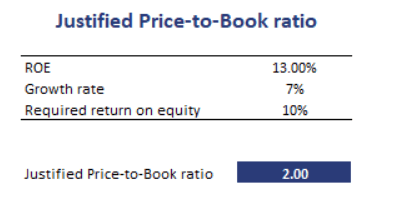

Justified price to book value formula. Price to book value p b ratio is a financial ratio measuring a company s market value to its book value. The book value of that company would be calculated simply as 25 million 100m 75m. Justified price to book value p b this ratio is probably one of my favourites due to the fundamental comparisons at its core between return on equity roe and the cost of equity also referred to as the required return on equity.

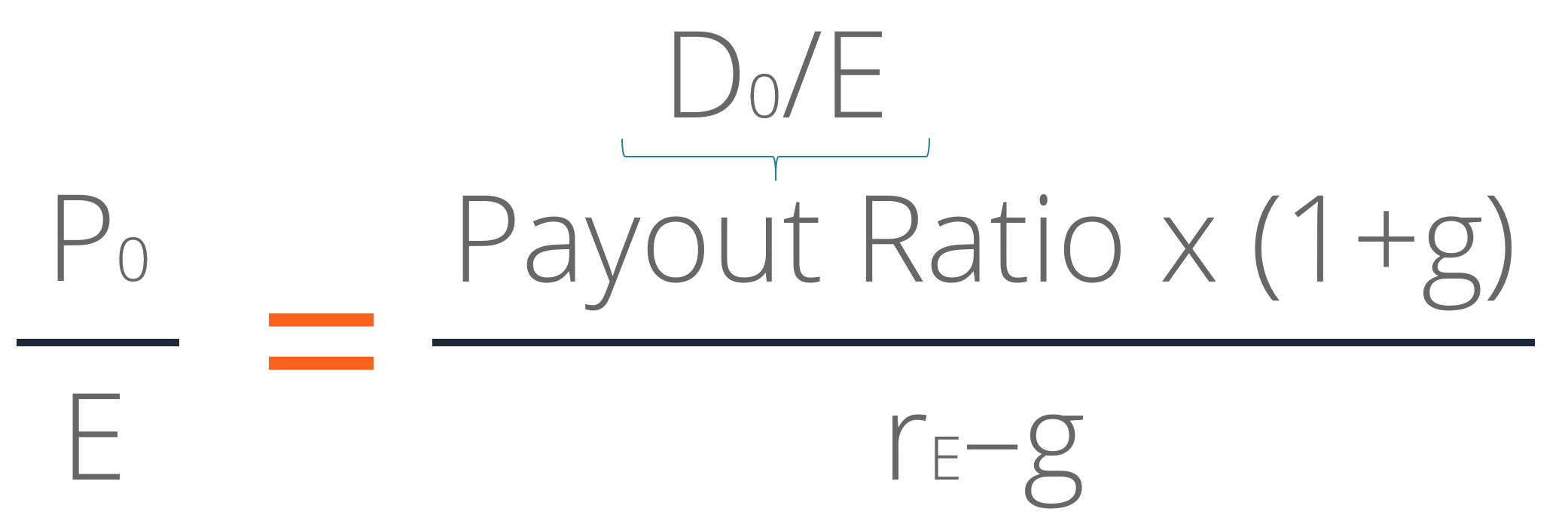

Put this into the formula and the justified p e is 14 0x. So the market is over valued by about 22 according to the formula. Return on equity roe is a financial ratio that measures profitability and is calculated.

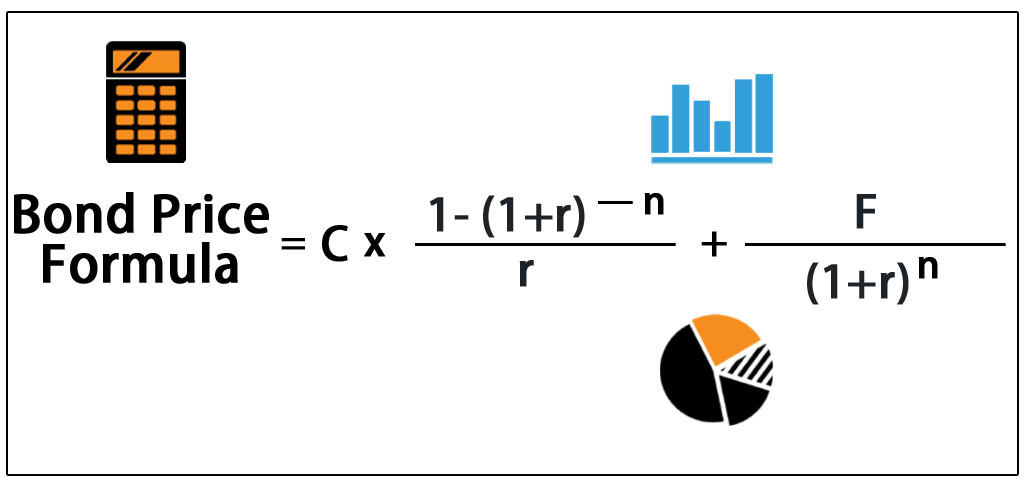

Definition lwhile the price to book ratio is a equity multiple both the market value and the book value can be stated in terms of the firm. Assuming a constant rate of growth the justified forward price to earnings ratio can be found using the following equation. To arrive at book value per share divide the book value by the number of shares outstanding as shown in the formula below.

Lvalue book value market value of equity market value of debt book value of equity book value of debt. Calculation of the justified value the value justified by fundamentals or a set of cash flow predictions of certain multiples offer an alternative way of estimating intrinsic value. The justified price to book multiple or justified p b multiple is a p b ratio based on the company s fundamentals.

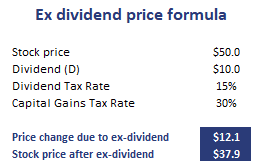

The market closed at 2 114 07 recently. Here s the formula of price to book value price to book value ratio market price per share book value per share. The output of the p b formula is a multiple of how much the equity of the business is being valued at.

The price to book value ratio p b formula is also referred to as a market to book ratio and measures the proportion between the market price for a share and the book value per share. So 14 0 x 118 47 1 658 09. Book value per share assets liabilities number of shares.